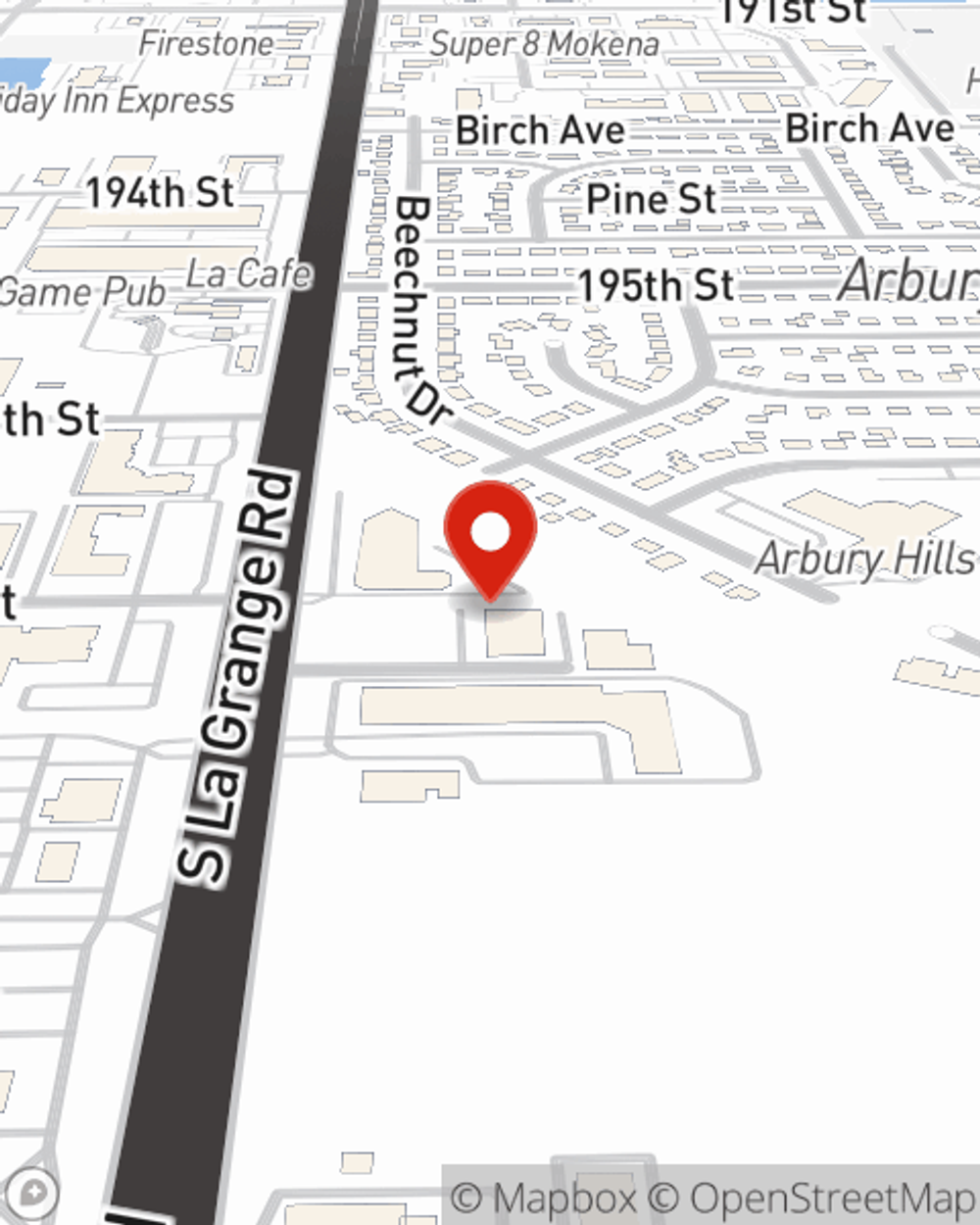

Life Insurance in and around Mokena

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Mokena, IL

- Frankfort, IL

- Tinley Park, IL

- Orland Park, IL

- New Lenox, IL

- Joliet, IL

- Plainfield, IL

- Shorewood, IL

- Coal City, IL

- Wilmington, IL

- Braidwood, IL

- Morris, IL

- Grundy County

- Will County

- Cook County

Be There For Your Loved Ones

State Farm understands your desire to protect the people you're closest to after you pass. That's why we offer terrific Life insurance coverage options and considerate caring service to help you pick a policy that fits your needs.

Get insured for what matters to you

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

When it comes to selecting what will work for you, State Farm can help. Agent Anthony Hakey can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, your physical health, and sometimes even personal medical history. By being aware of these elements, your agent can help make sure that you get a suitable policy for you and your loved ones based on your particular situation and needs.

To check out what State Farm can do for you, contact Anthony Hakey's office today!

Have More Questions About Life Insurance?

Call Anthony at (708) 390-0114 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Anthony Hakey

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.